Free School Meals policy means low income families could lose money for working extra hours

New analysis published today (Wednesday) shows that the Government’s failure to align its reforms affecting families and welfare will mean some low income families will be worse off by taking on additional hours of work.

The new report from Citizens Advice demonstrates for the first time the combined impact on families of various Government reforms to welfare, childcare and support towards paying for food at school and outlines proposals to solve the problems caused by flaws in the reforms.

Under the Government’s flagship reform Universal Credit, once a parent earns more than the threshold required to qualify for Free School Meals, they will face a cliff-edge effect resulting in extra hours of work leaving them financially worse off as they have to find money to pay for a school lunch for their children. For others, paying for additional hours of childcare will outweigh the financial gain from working an extra shift.

The exact threshold for Free School Meals under Universal Credit is yet to be confirmed. However in one scenario analysed by the charity, a working mum on minimum wage with two young children will be worse off working 24 hours a week than 16 hours. A mum of two teenagers could work 20 hours instead of 16 and find herself £4 a week worse off, enough to pay for three days of school meals.

Citizens Advice Chief Executive, Gillian Guy, said:

“Ministers are in danger of setting low income families a parent trap. It's vital that everyone, including parents on low wages, are able to gain financially from every hour they work.

“There is a risk that reforms will work against each other and harm the very people the Government aims to support. Families with young children should not have to have a maths degree to work out whether it pays to work extra hours. Ministers will be concerned that despite rightly wanting to simplify work incentives, their reforms are set to make life even more complex for people trying to raise a family.

“Simple changes to how Universal Credit operates would clear up so much of the confusion. Extra support for childcare, Free School Meals made available to the children of all parents receiving the new single benefit and allowing second earners to keep a larger share of their income would better reward work and simplify matters for parents.

The new report from Citizens Advice, ‘Pop goes the payslip’ analyses the impact of reforms on a range of typical families to measure their likely disposable income and incentives to work extra hours.

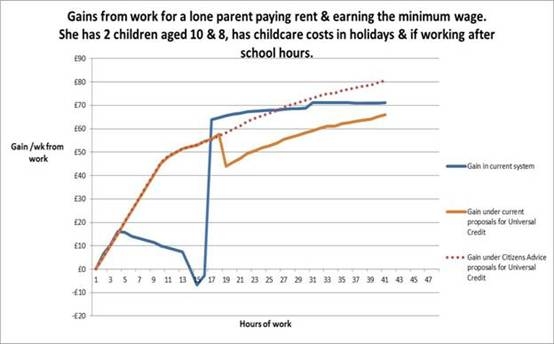

The graph below shows the experience of a lone parent with two children aged eight and ten who works for 16 hours each week on the National Minimum Wage. Under the current design of Universal Credit, with an earnings limit of £6,000 to qualify for Free School Meals, she would be no better working for 24 hours a week than 16. The extra hours she works would result in her crossing the earnings threshold under which parents qualify for their children to receive a Free School Meal. The dotted red line shows that under Citizens Advice proposals, she would gain financially from every hour she works.

To overcome the confusion and complexity which Universal Credit may bring to many families, Citizens Advice recommends a package of reforms which could be paid for by increasing the taper rate under Universal Credit – the rate at which earnings are deducted from people’s benefit payment – from 65p in every pound to 70p.

The £1.5 billion raised for the Exchequer by increasing the taper rate would ensure work always pays by funding:

- An extension the eligibility of Free School Meals, from every child in infant school, to every child in a household receiving Universal Credit.

- Increased support for childcare costs to 90 per cent from 85 per cent.

- Allowing a second earner in two parent households to keep an extra £50 a month of their earnings before their support is reduced.

- Giving women receiving Maternity Allowance the same amount of support as those receiving Statutory Maternity Pay.

- Ensuring widowed parents do not lose their support.

- Extra support for disabled people under the new benefit.

Notes to editors:

- The Citizens Advice service comprises a network of local bureaux, all of which are independent charities, the Citizens Advice consumer service and national charity Citizens Advice. Together we help people resolve their money, legal and other problems by providing information and advice and by influencing policymakers. For more see the Citizens Advice website.

- The advice provided by the Citizens Advice service is free, independent, confidential, and impartial, and available to everyone regardless of race, gender, disability, sexual orientation, religion, age or nationality.

- To find your local bureau in England and Wales, visit citizensadvice.org.uk. You can also get advice online at adviceguide.org.uk

- You can get consumer advice from the Citizens Advice consumer service on 03454 04 05 06 or 03454 04 05 05 for Welsh language speakers

- Citizens Advice Bureaux in England and Wales advised 2.3 million clients on 5.4 million problems from October 2013 to September 2014. For full 2013/2014 service statistics see our quarterly publication Advice trends

- Citizens Advice service staff are supported by more than 21,000 trained volunteers, working at over 3,000 service outlets across England and Wales.