3 in 4 of those in debt say money worries are harming their health

Debt problems are affecting almost every aspect of people’s lives, having a damaging impact on their work and home lives, family relationships and health, according to the results of a new Citizens Advice survey published today.

Around half of all respondents in employment and struggling with debt said their work performance was suffering (51%). Of these, 1 in 2 are finding it hard to concentrate at work (54%), while more than 1 in 3 (36%) are finding it difficult to do their jobs well.

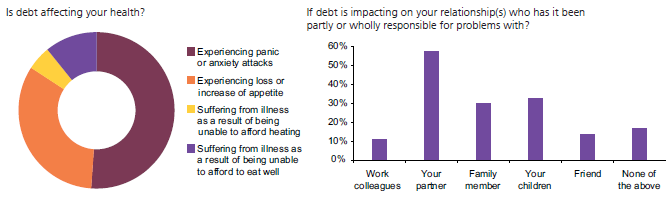

Well over half (56%) said worry about debt was affecting their relationships. Of these, more than 1 in 2 (57%) said debt was causing problems with their partner and 1 in 3 (33%) said it was causing problems in their relationship with their children.

Over 1,700 people experiencing debt problems completed the online survey which ran from 18 September to 26 November 2012. Most owed between £1,000 and £20,000 but around 1 in 10 owed more than £30,000.

Nearly 3 in 4 (74%) said debt worries were having an impact on their mental health, while more than 1 in 2 (54%) said their physical health was affected. Of those having health problems, just over half had experienced a panic or anxiety attack (51%). Almost 4 out of every 5 (79%) said they were losing sleep most nights because of debt.

Around 1 in 4 people in debt are trying to take their minds off their money worries by drinking (29%), eating (24%) and smoking (29%). Nearly 2 in 5 (38%) were taking no action to tackle their debts and hoping the problem would go away.

Outstanding personal debt stood at £1.415 trillion (including mortgages) at the end of September 2012, up from £1.406 trillion at the end of September 2011 (source: Credit Action), while mental health problems cost the country an estimated £77billion a year in healthcare, benefits and lost productivity (source: NHS).

Citizens Advice is urging people with money worries to seek advice from one of the hundreds of Citizens Advice Bureaux in England and Wales rather than allow financial problems to fester and take their toll on work, relationships and personal health.

Citizens Advice Chief Executive Gillian Guy said:

“We are seeing a debt epidemic in the UK which is affecting people from all walks of life. Debt can play havoc with family relationships, work and mental health which is why we are urging people struggling with money worries to visit one of our bureaux and get some free, independent debt advice.

“Our advisers deal with nearly 8,000 new debt problems every working day so we know debt can play a strong part in relationship breakdowns, ill-health and problems at work. It’s easy to understand why so many people try to ignore debt problems hoping they will go away, but that’s not the answer. Getting free, confidential, expert advice can make all the difference between getting on top of financial problems or seeing debts spiral out of control.”

In the 12 months up to 30 September 2012, Citizens Advice Bureaux in England and Wales helped with over 2 million debt problems – 30% of all bureaux enquiries – and CAB advisers are currently dealing with nearly 8,000 new debt problems every working day.

Citizens Advice Bureaux offer free, confidential, impartial and independent advice to help people solve debt problems. Advisers can help people prioritise their debts, talk through all their options, negotiate with creditors and make sure they are getting all the extra help they may be entitled to.

Download more data as graphs [ 0.78 mb]

Fact file

- Citizens Advice Bureaux in England and Wales have helped with 2.1 miliion debt problems in the last year. That’s nearly 8,000 every working day.

- In 2010/11, the Citizens Advice service successfully rescheduled debts totalling £113 million for 37,100 clients - an average of £12,600 per client.

- The UK owes £1.415 trillion in household debt, or £53,786 per household. (Source: Credit Action)

- In 2011, 119, 031 people in England and Wales were declared insolvent. (Source: ONS)

- There were 14,168 mortgage possession claims issued between July and September 2012. Over the same period, there were 38,947 landlord possession claims issued. (Source: Ministry of Justice)

- 16,618 businesses in England and Wales have gone into liquidation in the past year. (Source: ONS)

- 1 in 6 will suffer from a mental health problem at some point in their life. Mental health problems cost the country an estimated £77billion a year in healthcare, benefits and lost productivity. (NHS website)

Top tips

- Take action as soon as you think there may be a problem. There’s a lot you can do to help yourself so don’t bury your head in the sand - make sure you look at your options as early as possible.

- Don’t borrow more to pay off your existing debts. It may seem tempting in the short term, but all you’ll do is leave yourself with even more to pay off.

- Look at which debts are most important, not who is putting the most pressure on you to pay. Prioritise debts like mortgage or rent, council tax and gas and electricity. If you don’t pay these, you may be in danger of losing your home, having your power cut off or even ending up in court.

- Work out a household budget. You can use this to see where your money goes, where you could make savings and find out how much you can realistically afford to pay back each month.

- Contact your creditors. If they know you are having difficulty with repayments, you may be able to work out a manageable repayment plan.

- Shop around to make sure you’re getting the best deal on your energy bills, mortgage payments and other essentials.

- Get free, confidential, independent advice from your CAB. They will help you work out repayments and negotiate with your creditors, and also help you keep out of debt in the future. For more information go to the Citizens Advice website www.adviceguide.org.uk

Notes to editors

- The Debt Health and Wellbeing survey was conducted online between September 18 and November 26 – 1067 people who were experiencing problems meeting financial commitments took part

- The Citizens Advice service comprises a network of local bureaux, all of which are independent charities, and national charity Citizens Advice. Together we helppeople resolve their money, legal and other problems by providing information and advice and by influencing policymakers. For more information in England and Wales see www.citizensadvice.org.uk

- The advice provided by the Citizens Advice service is free, independent, confidential, and impartial, and available to everyone regardless of race, gender, disability, sexual orientation, religion, age or nationality. For online advice and information see www.adviceguide.org.uk

- Citizens Advice Bureaux in England and Wales advised 2.1 million clients on 6.9 million problems from April 2011 to March 2012. For full 2011/2012 service statistics see: www.citizensadvice.org.uk/press_statistics

- Out of 22 national charities, the Citizens Advice service is ranked by the general public as being the most helpful, approachable, professional, informative, effective / cost effective, reputable and accountable. (nfpSynergy’s Brand Attributes survey, May 2010).

- Most Citizens Advice service staff are trained volunteers, working at around 3,500 service outlets across England and Wales.