People with a mental health problem can pay a premium of over £1000 every year

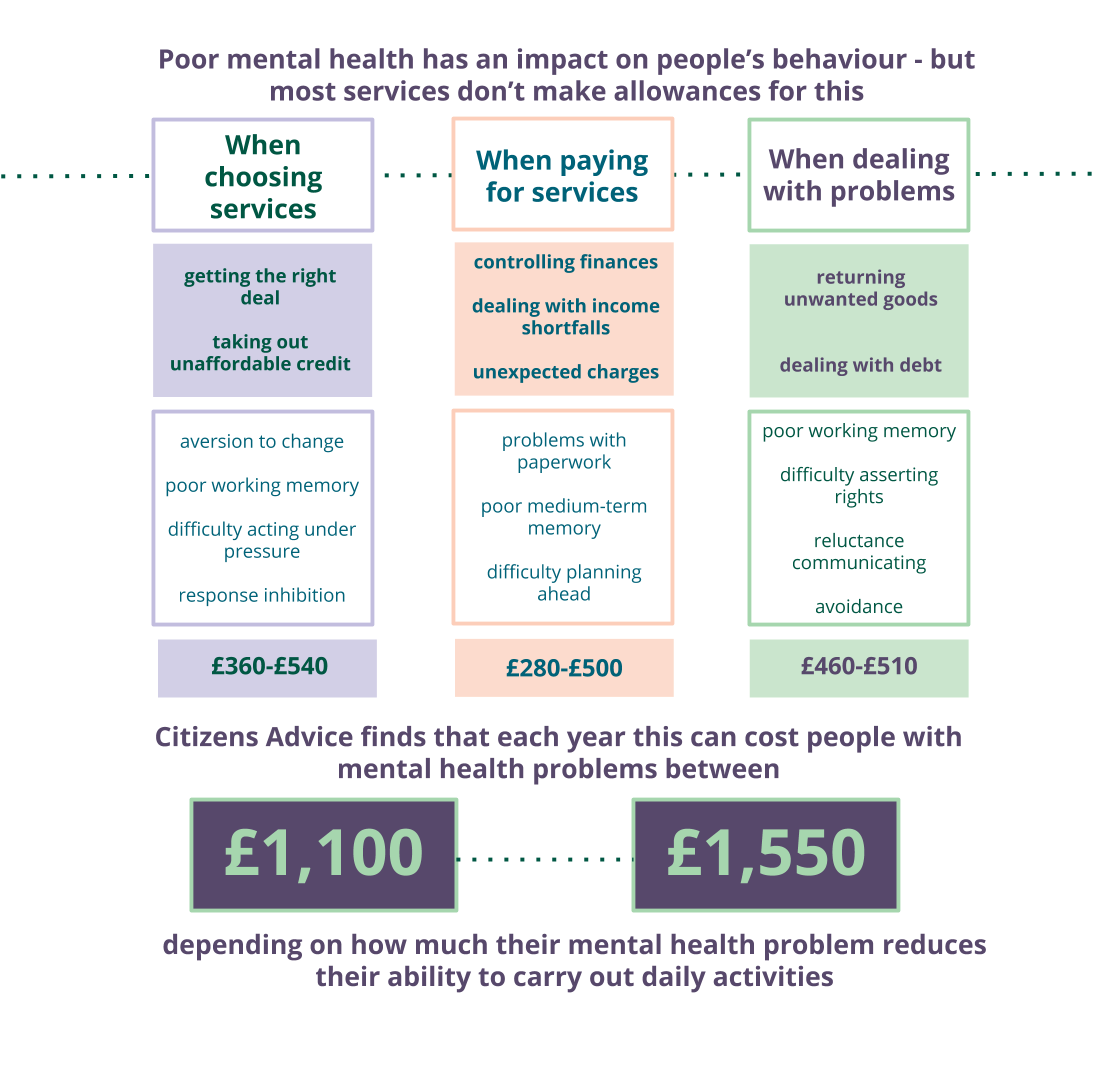

A lack of support means people with a mental health condition can pay between £1,100 to £1,550 a year more for essential services, new research from Citizens Advice shows.

This problem exists across energy, telecoms, current accounts and unsecured personal credit such as credit cards and overdrafts.

The charity has found that many companies are failing people with mental health problems. As the infographic below shows, a lack of support means those with a mental health problem are likely to face significant extra costs.

Poor mental health is the most common type of illness experienced by people Citizens Advice helps. In the last year nearly 90,000 of the people it has helped reported having a mental health problem. These conditions include anxiety disorders, depression and bipolar disorder.

Citizens Advice is calling for the relevant regulators (Ofgem, Ofwat, Ofcom and the FCA) to agree, and implement, minimum standards of support for people with mental health problems. These include:

If a customer with mental health problems is struggling to pay their bill, providers should be obliged to review their tariff and check it is the best one for their needs

Not having services disconnected due to debt or late payment - instead providers should work with customers to set up affordable payment plans

Priority repairs if their service is disrupted

Being able to communicate in a way that works best for them without being charged extra

The charity would also like to see regulators monitor firms’ performance and take enforcement action where needed.

Gillian Guy, Chief Executive of Citizens Advice, said:

“If you have a mental health condition, keeping on top of everyday tasks such as paying a bill, or solving a problem with a provider, can be especially challenging.

“Companies should be doing all they can to support vulnerable customers, but instead too many are being left to fend for themselves.

“Poor mental health is the number 1 health issue experienced by the people we help, and it is fundamentally unfair that they pay more for their essential services.

“Last year the government tasked regulators with making minimum standards for people with poor mental health a priority. Little has been done. This is a widespread problem and regulators need to step up and take action to ensure people are not being ripped off.”

Julia D’Allen, the coordinator for a mental health project at Citizens Advice South Somerset, said:

“Almost all of the people we help with mental health problems have financial issues as a result. They just don’t have the mental wellbeing to shop around for the best deals.“I’ve seen so many people whose broadband and phone packages have gone up after a year, they can’t afford it and they’re sinking into debt or having their phones cut off. For people with anxiety and depression, losing their phone and contact with other people is like losing a lifeline.“These companies do have good deals for vulnerable people but they’re not easy to access. It takes them coming to Citizens Advice and for us to really push, for these providers to relent and help their customer.“There’s nothing worse than when you see someone with depression who has tried to ask for help and got nowhere. They’ve been pushed further into their hole, they get further into debt and it becomes a vicious cycle.”

Len is a single father of 3, and helped by Julia. He said:

“Some days my mental health condition means it is difficult to function at all. I have Complex Post Traumatic Stress Disorder which means I experience exhaustion, depression and anxiety.

“This makes it difficult for me to communicate with companies. I need continuity and for things to be familiar to me but every time I get in touch, I have to speak to a different person. This also means I don’t want to change any of my contracts so stick with the same ones.

“I’ve had bad experiences when trying to get help so I now expect negativity when a financial situation occurs.

“I’ve had my broadband disconnected due to unpaid bills. I then had no way to fix the problem as my line of communication had been taken away. I felt isolated and this meant my mental health condition got worse and I got further behind on my payments.

“I don’t want to become or stay dependent and I am someone who is always finding ways to help myself but I’m struggling at the moment and need more support.

“I don’t think I should be paying more for my services because of my mental health condition.”

-ends-

For more information contact: Laura Albrey

Tel: 03000 231313

Out-of-hours contact number: 0845 099 0107

Notes to editors

The mental health premium does not include costs incurred due to problems with water suppliers, because the project’s initial phase of desk research found no direct costs for consumers in this market beyond their water bill itself. However, implementing minimum standards would still greatly improve customer service in this market and ensure people are treated consistently across services.

This report used a combination of desk research and 2 national surveys.

Desk research was used to identify areas where people with mental health problems are likely to incur costs as a result of symptoms often associated with mental health problems, and to quantify the average size of these costs.

Two national surveys were used to establish how many people with diagnosed mental health problems had experienced these costs. Fieldwork was collected by Comres between 17-31 May and 12 October - 5 November 2018 for the two surveys. Participants were recruited based on whether they had been diagnosed with a mental health problem. We split the datasets based on the self-reported impact of respondents’ mental health on their ability to carry out day to day activities. The second survey was weighted to match the first as closely as possible in this respect. Comres is a member of the British Polling Council and abides by its rules.

Both data sources were then combined into a model estimating the total impact of costs on someone whose diagnosed mental health problem reduces their ability to carry out day-to-day activities ‘a little’ or ‘a lot’. This model is adapted from that used by the University of Bristol in their Poverty Premium report.

89, 410 Citizens Advice clients have reported a mental health problem in the past year when asking for help

Citizens Advice is made up of the national charity Citizens Advice; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

Our network of charities offers impartial advice online, over the phone, and in person, for free.

We helped 2.6 million people face to face, over the phone, by email and webchat in 2017-18. And we had 25 million visits to our website. For full service statistics see our monthly publication Advice trends.

Citizens Advice service staff are supported by more than 22,000 trained volunteers, working at over 2,500 service outlets across England and Wales.

You can get consumer advice from the Citizens Advice consumer service on 03454 04 05 06 or 03454 04 05 05 for Welsh language speakers.