Citizens Advice responds to FCA research on financial resilience in the pandemic

Citizens Advice has responded to new research by the financial regulator, the FCA, indicating two million people have moved into a financially fragile situation - or have “low financial resilience” - since February.

Dame Gillian Guy, Chief Executive of Citizens Advice, says:

“This is further evidence that coronavirus has had a calamitous effect on people’s ability to make ends meet.

“Our research shows that while protections for people struggling with household bills are strong in some areas, they are inadequate in others. This is particularly the case for council tax and rent, which are many people's largest monthly outgoings.

“With the finances of 12 million people now fragile, there’s a real possibility that new lockdown restrictions will force many people into debt this winter.

“It’s in the government’s power to prevent this happening. By strengthening the support for those struggling with essential bills and retaining the £20 a week uplift to Universal Credit beyond the spring, they can make sure no one sinks into debt through no fault of their own.”

Background

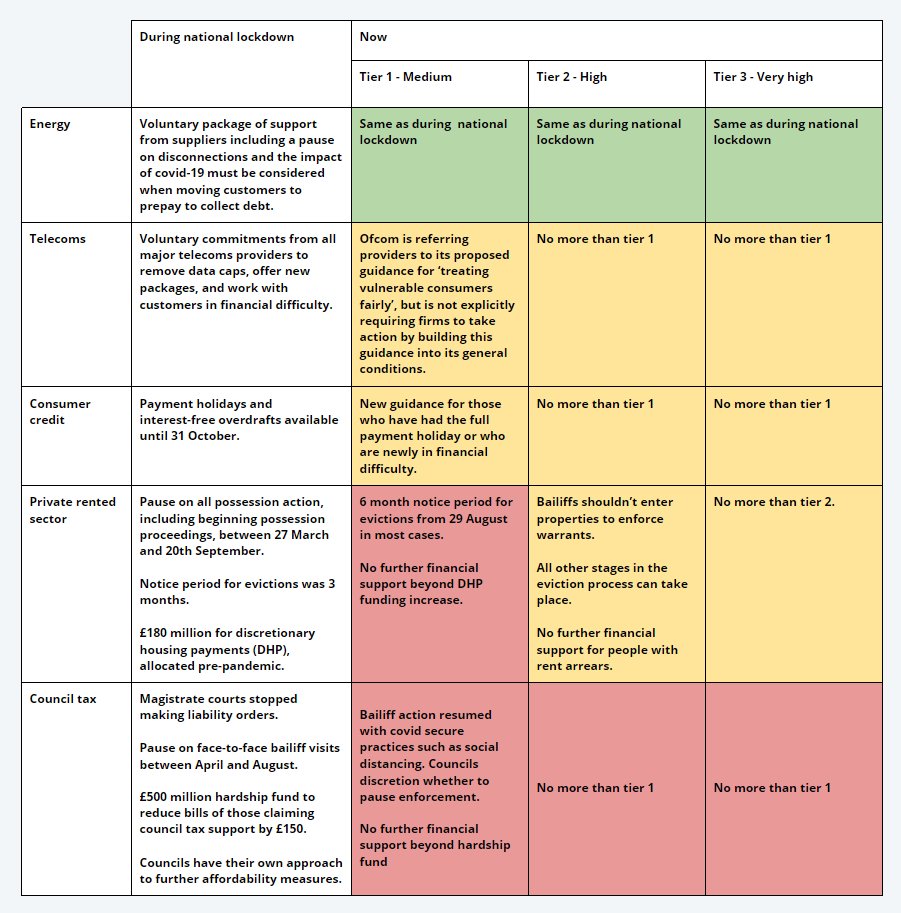

This week Citizens Advice published new analysis of the protections available for people struggling to pay their household bills, highlighting rent and council tax as areas where existing support is insufficient.

Last week new research from Citizens Advice showed significant numbers of people risk being pushed into a position where they can’t pay their essential bills and could face spiraling debts if the uplift to Universal Credit and Working Tax Credit is not extended beyond April 2021. 75% of people in receipt of uplifted benefits who seek Citizens Advice’s help with debt would be unable to meet their essential costs if the uplift was removed.

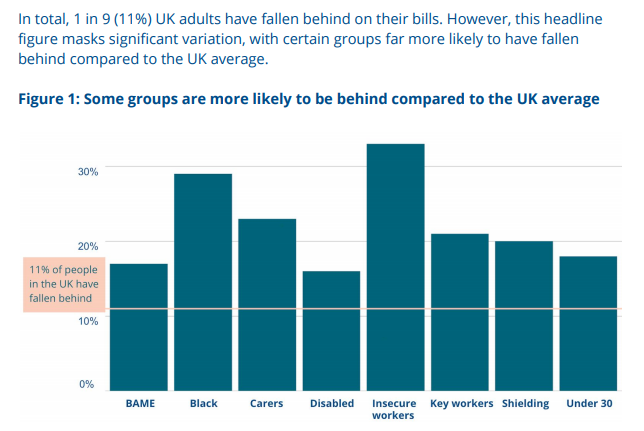

In August, Citizens Advice found one in 9 people, the equivalent of 6 million people across the UK, have reported falling behind on household bills because of coronavirus. This research suggested that certain groups of people (shown in the chart below) had fallen behind on bills more than the national average.

Since the UK entered the first lockdown in March 2020, Citizens Advice has helped over 117,000 people with one-to-one debt advice.

Notes to editors

Protections for people falling behind on household bills differ in the devolved nations. The recommendations above apply to England. You can find more details of the support available in Wales , Scotland and Northern Ireland .

Polling for the research published in August was carried out by Opinium who surveyed 6,015 adults online, between 29 June and 8 July. Data was weighted to be nationally representative of the UK.

Citizens Advice is made up of the national charity Citizens Advice; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

Our network of charities offers impartial advice online and over the phone, for free.

We helped 2.8 million people face to face, over the phone, by email and webchat in 2019-20. And we had 34.5 million visits to our website. For full service statistics see our monthly publication Advice trends.

Citizens Advice is the largest provider of free, multi-channel debt advice. Providing that help gives Citizens Advice unique insight into the types of debts people struggle with.

You can get consumer advice from the Citizens Advice consumer service on 0808 223 1133 or 0808 223 1144 for Welsh language speakers.